Another new podcast for you this week, with another special guest – this time Merryn talks to Anand Giridharadas, author of Winners Take All: The Elite Charade of Changing the World. Tony Blair isn’t keen on Giridharadas apparently, which may be all the recommendation many of you need.

For those who need a little more persuading, he makes the case that the billionaire class who attend Davos are entrenching their own dominant positions under the guise of pretending to help out via philanthropic, self-aggrandising “world improvement” schemes.

Agree or not, you’ll find the conversation stimulating (it also offers an interesting insight into how chattering-class Americans regard – and in my view, misunderstand – the whole Brexit scenario), and Merryn, as ever, doesn’t give Merryn talks to Anand Giridharadas.

And if you have any questions that you’d like Merryn and I to address, please do send them in to editor@moneyweek.com. Put “Question for the podcast” in the subject line and we’ll see what we can do. We’ve already had some excellent questions on inflation and interest rates, which we’ll queue up to address in future discussions.

For more down-to-earth practical advice on how to improve your personal finances, you should also check out Merryn’s piece on why apathy or loyalty as a consumer of finance products is a disastrous mistake – never take the default deal.

And if you missed any of this week’s Money Mornings, here are the links you need.

Monday: What to watch this week: the Bank of England, housebuilders and Google

Tuesday: Why every fund manager should employ a monkey

Wednesday: Sterling might struggle as we approach Brexit Day – but long term it’s a buy

Thursday: House prices in the UK are now falling – which is great news

Friday: Only one thing doesn’t change in markets – human behaviour

And another reminder – we’re holding an event in London on Tuesday 12 February, where I’ll be talking to MoneyWeek regular Tim Price and Netwealth’s Iain Barnes about the latest goings on in the market. There are just a handful of tickets left – get yours here if you haven’t already.

And now, over to the charts.

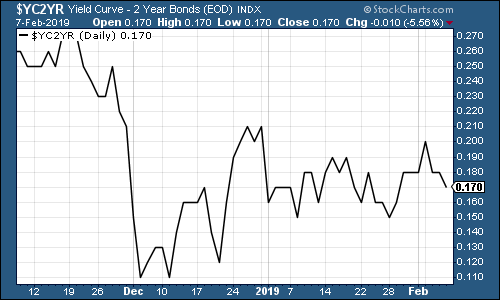

The yield curve (here’s a reminder of what it is) is still struggling to make much headway, despite the Federal Reserve’s big shift in attitude on interest rates. Investors are clearly still more concerned that we’re heading for a slump rather than any sort of inflationary growth.

The chart below shows the difference (the “spread”) between what it costs the US government to borrow money over ten years rather than two. Once this number turns negative, the yield curve has inverted which almost always signals a recession (although perhaps not for up to two years).

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

After last week’s excitement, gold (measured in dollar terms) has consolidated somewhat.

(Gold: three months)

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – recovered sharply this week, which is one reason risk appetite took a turn for the worse.

(DXY: three months)

The ten-year US Treasury bond yield was little changed; the Japanese government bond (JGB) yield remained negative; and the yield on German government debt slipped further amid ongoing fears about the eurozone’s key economy.

(Ten-year US Treasury yield: three months)

(Ten-year Japanese government bond yield: three months)

(Ten-year bund yield: three months)

Copper has been on a run recently amid optimism over a possible trade deal between the US and China. However, towards the end of the week, it lost its momentum as concerns grew that the two sides are further apart than markets had been hoping.

(Copper: three months)

The Aussie dollar – our favourite indicator of the state of the Chinese economy – was also hit hard by concerns over the absence of a US deal with China.

(Aussie dollar vs US dollar exchange rate: three months)

Another week in which cryptocurrency bitcoin barely moved.

(Bitcoin: ten days)

The four-week moving average of weekly US jobless claims rose this week to 224,750, as weekly claims fell back to 234,000. According to past research by David Rosenberg of Gluskin Sheff, US stocks typically don’t peak until after the moving average of jobless claims has hit a low for the cycle. On average, the stockmarket peaks about 14 weeks after the trough, with a recession following about a year later. (This is taken from a very small sample, so it needs a big pinch of salt.)

The most recent trough came on 15 September, at 206,000. If that was the bottom, it implies that the market has already peaked, and that a recession may follow this year or in 2020. We’ll hopefully get a better view once the disruption caused by various holidays and the government shutdown is out of the way.

(US jobless claims, four-week moving average: since January 2016)

The oil price (as measured by Brent crude, the international/European benchmark) remains stuck in a very narrow range. Nerves over growth seem to be offsetting any concerns about declines in Venezuelan production.

(Brent crude oil: three months)

Internet giant Amazon is still wobbling along after telling investors at its most recent update that it plans to invest more heavily this year.

(Amazon: three months)

But electric car group Tesla also took a knock on news that Amazon is investing in a self-driving car startup (Aurora Innovation). Amazon is still the great disruptor it seems, even for other disruptors.

(Tesla: three months)

Have a great weekend. And don’t forget to get your get yours here if you haven’t already.!