This article is taken from our FREE daily investment email Money Morning.

Every day, MoneyWeek’s executive editor John Stepek and guest contributors explain how current economic and political developments are affecting the markets and your wealth, and give you pointers on how you can profit.

The global growth scare isn’t going away yet.

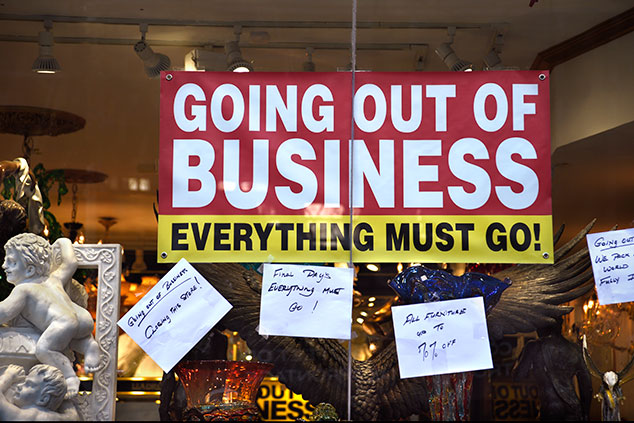

Yesterday, we heard that retail sales in the US collapsed by 1.2% in December (or 0.9% excluding sales of petrol). That’s the worst monthly fall since September 2009.

That’s pretty grim. Then this morning, we got news of weakening factory gate inflation in China.

Meanwhile, it turns out that Germany only just missed falling into recession last quarter.

It’s all worrying stuff. But I wouldn’t be too quick to turn bearish.

The economy has a tricky relationship with the stockmarket

Global economic data has been going through a rough patch. And news that US shoppers had gone on strike in December was a particularly nasty surprise.

It’s worth remembering that all of this data is being compiled around a chaotic time for the US government. So I wouldn’t put too much store in this single month’s release. But it gives increasing credence to the idea that the economy is slowing a lot faster than anyone thinks.

However, it’s always worth remembering a couple of points. Firstly, the relationship between economic growth and stockmarkets rising is a very vague one. In the very long run, growth and markets are linked. But in the short-to-medium term, there’s really not much useful to say about the correlation between the two.

Meanwhile, there’s a big factor that has a much more significant effect on markets – monetary policy. And on that front, things are definitely turning in the markets’ direction.

Central banks appear to have decided in the last six weeks or so, that discretion is very much the better part of valour. It increasingly looks as though they are not just retreating from tightening monetary policy, but thinking about loosening it again.

For example, even if Brexit goes smoothly and UK growth bounces, the Bank of England is only likely to raise rates once this year, according to Gertjan Vlieghe, a member of the Bank’s interest-rate setting committee. “I feel I can probably wait to see evidence of growth stabilising and inflation pressure rising before considering the next hike in bank rate.”

More importantly, America’s central bank, the Federal Reserve, is sounding ever-more dovish by the day. Yesterday, Lael Brainard, a member of the Fed’s board of governors, warned that “downside risks” are increasing. The Fed has already effectively told markets that it probably won’t raise interest rates again this year.

Now Brainard reckons that quantitative tightening (QT, or money burning – the opposite of quantitative easing) will also stop this year. “My own view is that the balance sheet normalisation process should probably come to an end later this year.”

That’s a far cry from the view that her boss, Jerome Powell, was expressing right up until late last year. As far as the Fed was concerned in 2018, QT was an admin thing that shouldn’t have any real effect on markets. It was going to be on “autopilot” until at least next year – or even 2021.

Whatever else is going on in the economy, we should have learned by now that central banks capitulating is a positive for asset prices.

Why the Fed could end up buying more US Treasuries this year

So on the one hand, we have a lot of wobbly economic data. On the other hand, central bankers have already given up on the idea of tightening monetary policy at all, it seems.

That suggests to me that – again – we have the potential for surprising to the upside this year, rather than the downside.

We do have to keep an eye on the growth data, but Will Denyer of Gavekal points to an interesting possibility. The Fed currently holds a mix of private sector debt and US government debt. Ideally, the Fed probably wants to get rid of all its private sector stuff (mainly mortgage-backed securities) and end up with a “clean” balance sheet, holding only government debt.

One way to do this, says Denyer, would be to allow the mortgage-backed securities to mature, but to reinvest the proceeds in US Treasuries. So you end QT – you keep the size of the Fed’s balance sheet stable – while simultaneously soaking up some of the ever-expanding supply of Treasuries.

In other word, the Fed becomes “more squarely focused on helping the US government spend money like a drunken sailor”, as Denyer puts it.

What would that mean? If the Fed is buying Treasuries, that means there are fewer for the private sector to buy. That means investors are more likely to buy higher-risk assets. In short, the QE “hot potato” effect reappears – people who would have bought Treasuries buy something a bit more risky instead, and so on up the line.

Combine that with a revival of growth and inflation expectations, and you have a recipe that’s good – for now – for share prices and somewhat negative for bonds.

And of course, it’s another step along the road to an inflationary denouement. Let’s see what happens.