Marshalls (LSE: MSLH) makes concrete and stone paving for retail outlets and the construction industry, operating throughout the UK. Business has held up well despite “ongoing macro-economic and Brexit uncertainty”, as the group’s chair Vanda Murray puts it.

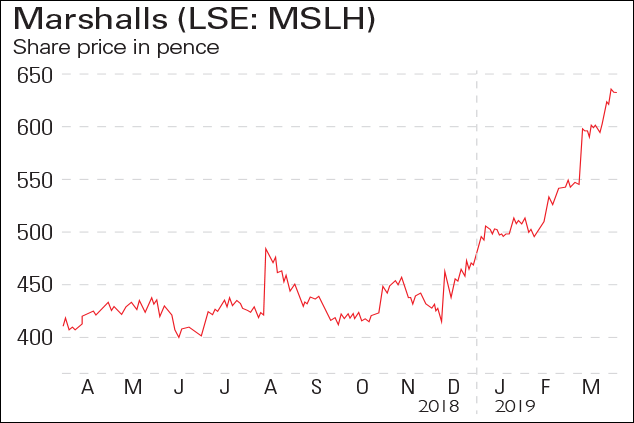

A combination of organic growth and bolt-on acquisitions boosted revenue by 14% to £491m in 2018, while pre-tax profits climbed by 21% to £62.9m. Early 2019 seems to be continuing in the same vein, with sales up by 16% year-on-year in the first two months. The share price has risen by 57% in the last year.

Be glad you didn’t buy…

Anglo-German tour operator TUI (LSE: TUI) was already under pressure even before it was caught in the fallout from two recent Boeing 737 Max aircraft crashes. It issued a profit warning in February, blaming the hot summer weather in the UK and a weakening pound, which meant it would not hit its 10% annual-growth target. Now it has issued another, saying the disruption caused by having its 737 Max planes (10% of its fleet) grounded could cost it up to $300m, depending on when the planes are allowed back in the air. The stock has fallen by 50% in a year.