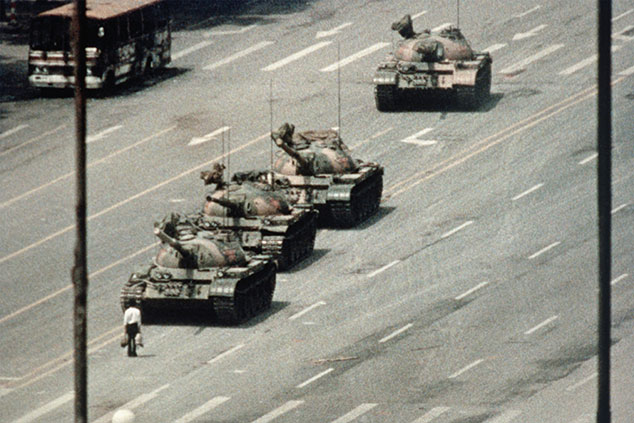

“China’s Communist rulers continue to keep up their end of a compact made with the populace ever since the Tiananmen Square massacre of 1989: no democracy, in return for sustained economic growth of more than 6% per year,” says Authers. The current round of stimulus shows just how determined policymakers are to bolster growth as the country marks its navy’s 70th anniversary, according to Diana Choyleva of Enodo Economics.

A key reason the economy had lost steam was weaker consumer demand in cities. Despite better-than-expected economic growth in the first quarter, China’s job market saw its lowest level of demand for workers in six years, says the South China Morning Post.

The stimulus is working…

Last year, China’s stockmarket was slumping, and the economy suffered from the trade war with the US. So Beijing decided to switch gears and stimulate the economy once again. The government cut personal income and corporate taxes, while banks were told to start lending more to smaller businesses. It has also hit the “fast-forward button” on infrastructure spending, says The Economist. After holding off from approving new projects, because officials were still worried about reining in debt, it now aims to build 3,200 kilometres of high-speed rail lines this year. “That is nearly as much as Spain, the country with the second-largest high-speed rail network, has in total; for China, though, it is down from an average of 3,600km annually over the past five years.” Sales of excavation equipment, which are a proxy for construction and economic activity, soared to an eight-year quarterly high.

… but it’s obscuring long-term problems

The short-term backdrop may be auspicious, but the longer-term outlook is murkier. Repeated stimuli mean that China keeps blowing up its massive debt bubble, now worth 260% of GDP. “Policy stimulus can counter cyclical weakness,” says Neil Shearing of Capital Economics. But leaders aren’t addressing “deeper-seated constraints that have built in its economy”.

It’s not just a question of excessive borrowing clogging up the system. There’s also the “political stance that works against needed reforms and private firms to the benefit of state enterprises and public ownership”, says George Magnus in Prospect magazine. The Communist party is reluctant to embrace economic liberalisation, while state-owned companies benefit from subsidies, access to credit, tax breaks, market access, and legal protection – to the long-term detriment of productivity, growth and equity returns.