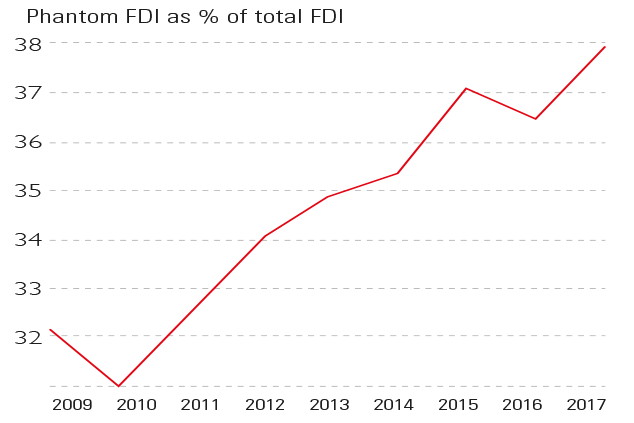

Foreign direct investment (FDI) is supposed to stimulate productivity and growth in other countries by transferring skills, technology and capital. But a large percentage of the world’s total FDI isn’t doing that, according to a study by the International Monetary Fund and the University of Copenhagen. Around $15trn, or 40% of the global total, is “phantom” investment, with money coming in, but not stimulating business activity. Multinational companies are channelling cash through “empty corporate shells” in other jurisdictions to minimise their tax bill. Luxembourg and the Netherlands account for half the phantom FDI. In Malta, Ireland and Switzerland less than 50% of FDI is real.

Viewpoint

“Much has been said about whether… ‘fossil-fuel billionaire’ David Koch and his brother Charles were ultimately responsible for the triumph of [Donald] Trump… The argument is that the use on a colossal scale of the Kochs’… ‘dark money’… fertilised the harsh soil in which Trump’s support flourishes. But the path was cleared for him a generation ago by another corporate celebrity… Lee Iacocca… who rescued Chrysler from… bankruptcy. Iacocca’s rants against Japanese incursions into the US car market, and the macho persona he projected in Chrysler television ads, won him such blue-collar popularity that he was urged to become a Democrat presidential candidate… if he had he might have beaten George Bush Sr in 1988 — and… the idea was born that business braggadocio plus protectionist rage add up to the kind of statesmanship American voters admire.”

Martin Vander Weyer, The Spectator