Not one, but two podcasts this week!

Our recent podcast drought has given way to a flood. This week, in our usual podcast, Merryn and I discussed the WeWork flop, the European Central Bank’s craftier-than-realised monetary policy strategy, and the opportunities in fossil fuels.

And there’s also a bonus podcast in the form of a recording of one of Merryn’s Adam Smith shows, which took place up in Edinburgh last month. She and her panellists – comedian Simon Evans, fund manager Anna MacDonald, and Martin Currie chairman Willie Watt – talk about everything from globalisation to virtue signalling. Don’t miss this (and book some space in your diary for a trip to Edinburgh next August).

Don’t miss the Wealth Summit – our guest line up is incredible

Oh, and be sure to book your ticket for the MoneyWeek Wealth Summit in London on 22 November.

Guests already include Bank of England chief economist Andy Haldane, Helena Morrissey of Legal & General, Sebastian Lyon of Troy Asset Management (Sebastian works closely with Personal Assets Trust), MoneyWeek reader favourite James Ferguson of the MacroStrategy Partnership, and many, many more, including top fund manager James Anderson (Scottish Mortgage) and always fascinating financial analyst, Russell Napier.

With a stellar line-up like that (and more to come, believe me), it’s no wonder tickets are selling fast. Seriously,the Wealth Summit

Money Morning and Money Minute

If you missed any of this week’s Money Mornings, here are the links you need:

Monday: Could spiking oil prices burst the bubble in bonds?

Tuesday: WeWork has shelved its IPO – has the top of the market been postponed?

Wednesday: What will it take for platinum to make a comeback?

Thursday: Low unemployment, solid growth, steady inflation – of course the US needs an interest-rate cut

Friday: How to cope with a market that feels extremely fragile

Currency Corner: Is it comeback time for the pound?

Subscribe: Get your first 12 issues of MoneyWeek for £12

And I’m still interested in your comments on Money Minute. The format is settling down now, so let me know what you think, and if there are any changes you’d still like to see. Email editor@moneyweek.com (put “Money Minute” in the subject line).

The charts that matter

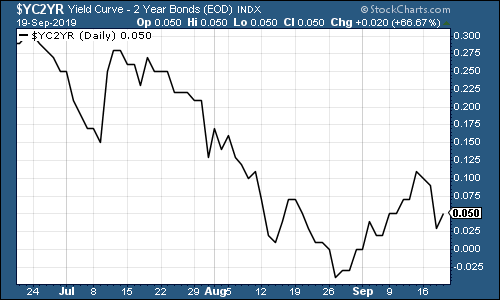

Onto the charts. The yield curve is still in positive territory – in other words, the yield on the ten-year US government bond is higher than the yield on the two-year – although barely. (Here’s why the yield curve matters).

However, the curve did invert a few weeks ago, albeit briefly, and this has been a good recession indicator (given the limited data set) in the past. That said, the recession could be anything up to two years away, and still fall within the category of “accurate yield curve predictions”. So it’s not much use for timing the market (not much is, of course).

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

Gold (measured in dollar terms) meandered around last week. On the one hand, the wider market is feeling less fearful (which is not good for gold, typically). On the other, there are still a lot of weird things going on, as I noted in How to cope with a market that feels extremely fragile

(Gold: three months)

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – was little changed this week.

(DXY: three months)

Meanwhile, the number of Chinese yuan (or renminbi) you can get to the US dollar (USDCNY) remained above the ¥7.0 level, but remained well below its recent highs.

(Chinese yuan to the US dollar: three months)

As for ten-year yields on major developed-market bonds – yields have pushed higher from their recent panic lows, but we’re hardly out of the woods yet. Here’s the US ten-year yield:

(Ten-year US Treasury yield: three months)

And Japan’s…

(Ten-year Japanese government bond yield: three months)

And Germany’s.

(Ten-year Bund yield: three months)

After rallying last week, copper took a hit early in the week after Chinese manufacturing data was worse than expected.

(Copper: three months)

The Aussie dollar fell back after its recent gains, partly on expectations that the Reserve Bank of Australia will cut interest rates when it meets early next month.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin rambled around and then started to stall near the end of the week, dropping below the $10,000 mark, before rebounding to end the week having changed very little.

(Bitcoin: ten days)

US weekly jobless claims were once again lower than expected, coming in at 208,000, compared to 206,000 last week (this figure was revised higher from 204,000). The four-week moving average came in at 212,250.

The reason we watch this measure is because a sustained uptrend would indicate that a recession is on the way. While this measure is still hitting fresh lows or hovering around them (the last ‘trough’ was about five months ago, as you can see on the chart), it’s very unlikely that the good times are over.

Of course, we could still get a recession within the timescale predicted by the recent yield curve inversion (about 2 years from now) and yet also see a fresh high on the stock market and a fresh low in the jobless figures before then. (You can see why market timing is not generally considered a winning strategy, given all of these apparently useful and yet essentially unhelpful timing indicators).

(US jobless claims, four-week moving average: since January 2016)

The oil price (as measured by Brent crude, the international/European benchmark), of course, had a wild week. At the end of last week, it was falling because Donald Trump had fired John Bolton as an advisor, which was deemed to lessen the odds of a war with Iran. Then, at the weekend, a Saudi oil facility was targeted in a drone strike, which knocked out half of SaudiArabia’s production and was rapidly blamed on Iran.

Crude rocketed on Monday morning, but spent most of the rest of the week sliding back as the Saudis said that the production hit wouldn’t be as bad as thought. I think you could still be forgiven for thinking that the market is perhaps being a little too calm about this (it’s only about $3 higher than it was before we learned that someone in the region has the power to knock out a great deal of Saudi capacity at short notice, which seems complacent) but let’s see what happens.

(Brent crude oil: three months)

Internet giant Amazon had a fairly undramatic week, with its share price changing very little. The biggest news involving Amazon wasn’t directly about the company itself – it was about delivery giant FedEx’s decision to drop the ecommerce giant as a client, because Amazon is now too much of a competitor in the logistics field. Which, of course, goes to show just how widespread the Amazon “disruptor” effect really is.

(Amazon: three months)

Electric car group Tesla was little changed this week too. The stock is still down around 25% for the year so far, but it’s managed to avoid headline-grabbing bad publicity for at least a few weeks now, which is good by this company’s standards.

(Tesla: three months)

Have a great weekend. And don’t forget to the Wealth Summit